-

Private Equity: What’s in it for the Doctors?

Private equity firms increasingly are investing in healthcare businesses, many of them physician practices – with doctors at the core of operations. How should doctors assess the economics of such deals? What will be the impact on care? What questions should they ask of financial partners who propose to invest in or acquire these practices?…

November 8, 2019More -

Disrupted Healthcare: Is Your Business a Netflix or a Blockbuster?

Two healthcare business experts from RSM discuss important disruption trends that will leave many legacy companies in the same position that Blockbuster’s video-rental business found itself as Netflix grew in popularity. Patients increasingly expect the same types of experiences in healthcare that they receive in consumer businesses. Please download the RSM healthcare M&A e-book here

November 4, 2019More -

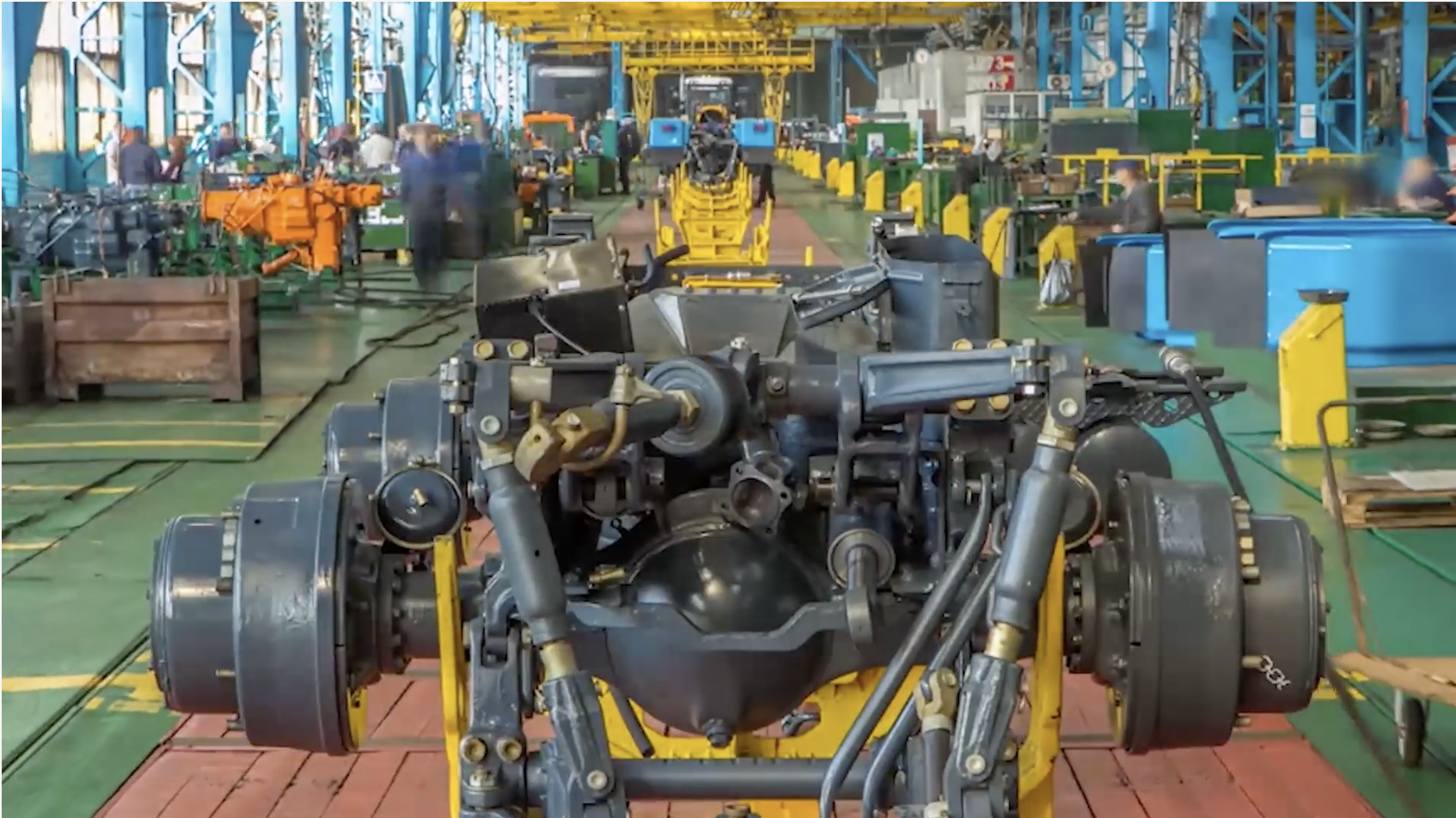

Gasket Crisis Averted: How Sun Capital Turned Around an OEM in Four Days

Marc Leder, co-founder of Sun Capital Partners, discusses one of his favorite deals – the brisk turnaround of Raybestos Powertrain, a supplier of parts to the automotive industry that was facing liquidation. An unexpected price rise saw Leder fielding worried phone calls from top car executives.

October 28, 2019More -

Dealmaker: New Frontiers in Financial Services

Privcap assembled a group of private equity experts for an in-depth conversation about the investment opportunity in financial services. Commentators include William Spiegel of Pine Brook and Anthony DeCandido and Michael Fanelli of RSM. Topics include the decline of legacy players in financial services, the futility of traditional banks serving coffee, the disintermediation of mortgage…

October 28, 2019More -

The Best Energy Play: Permian Infrastructure

And why the Permian should be thought of as its own country, according to the former head of energy at Trammell Crow.

October 22, 2019More -

How Corporates are Going Green: The Rise of Renewable Power-Purchase Agreements

Far from witnessing “doom and gloom” around climate change, two leaders in renewable energy at KPMG are working with corporations around the world to transfer from “brown energy” to green. The shift is starting with Corporate Power Purchase Agreements (CPPAs) whereby massive consumers of energy contract with renewable suppliers for direct access to green energy….

September 17, 2019More -

The Challenge of Building a Bot

RSM’s Dave Noonan describes how his firm helps clients deploy robotic process automation.

RPA: Where to start

Robotic process automation (RPA) is a game changer for organizations looking to drive innovation and efficiency. Private equity firms are increasingly helping their portfolio companies automate tasks that were once manual, cutting expenses and improving accuracy in the…

September 16, 2019More -

Measuring the ROI in Robotics

Robotic Process Automation is strongly associated with reducing costs in businesses, but if executed properly it can allow employees to be more efficient and focus on higher-value tasks. A group of experts from General Atlantic, RSM and Automation Anywhere shares expert views. Part 3 of a series.

RPA: Where to start

Robotic process automation (RPA)…

September 16, 2019More -

So Where Do I Start? CEOs Seek Guidance on Automation

CEOs and their private equity partners are keenly aware that automation technologies can transform their business processes, but they usually don’t know where to begin. Three experts from General Atlantic, Automation Anywhere and RSM talk about the right way to roll out an automation effort at your business.

RPA: Where to start

Robotic process automation…

September 9, 2019More -

Core Real Estate: The Global Opportunity

As real estate has grown into an important part of an institutional portfolio, the popularity of core real estate has surged. And yet the definition of core has morphed in recent years. In addition, outside of the U.S., notably in Europe and Asia, investors are eager to put capital in core assets but sometimes disagree…

September 4, 2019More -

Why Women in Private Equity Need ‘Superpowers’

Gretchen Perkins, the head of business development at middle-market private equity firm, Huron Capital, talks about the woeful lack of women in private equity and what must be done to attract more, particularly at the higher ranks.

September 3, 2019More -

Mentoring At-Risk Girls, the Women of Tomorrow

A private equity executive discusses her work with Women of Tomorrow, which helps low-income girls improve their lives and plan for college.

August 19, 2019More